The following post contains affiliate links. If you sign up through this site, I stand to make a modest commission.

For those of us interested in pursuing early Financial Independence, fundamental assumptions that hold true for the population at large are not necessarily true for physicians and other high-income professionals.

I recently posted about how a friend challenged my assumptions about what my greatest annual expenses were. I'd taken for granted that housing, transportation and food were my "big three," because many authoritative bloggers had stated unequivocally that this was the case. I was wrong.

The tool that quickly disabused me of my erroneous assumption was Personal Capital. You've probably seen their name before.

What's the big deal about Personal Capital?

You can analyze your portfolio as whole. It's like having a magic elf perform the tedious parts of spreadsheet data entry.

First, you can link many different accounts to their software so your portfolio can be viewed and analyzed as a whole. I am able to link our checking accounts, taxable brokerage accounts, 401k, profit-sharing, and defined benefit plans. I can even link our kids' 529 plans and our home value.

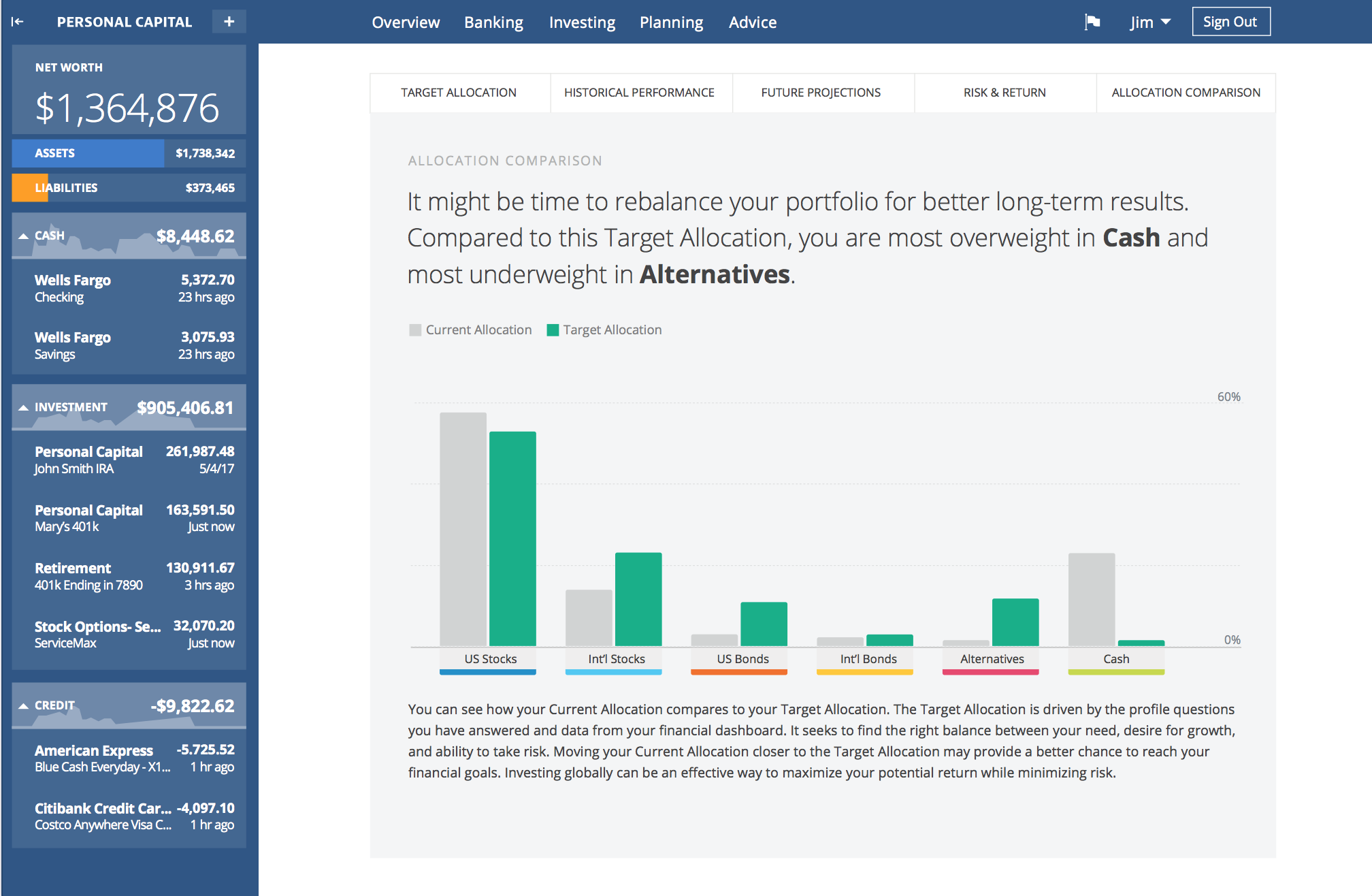

By linking all our accounts, I can see precise percentages that I hold in total stock market or international stock index funds. Before making monthly retirement contributions, I log on to see what asset class is furthest below my target allocation and purchase it accordingly, rebalancing with new contributions.

Personal Capital provides free use of tools you formerly needed to have a financial advisor in order to access.

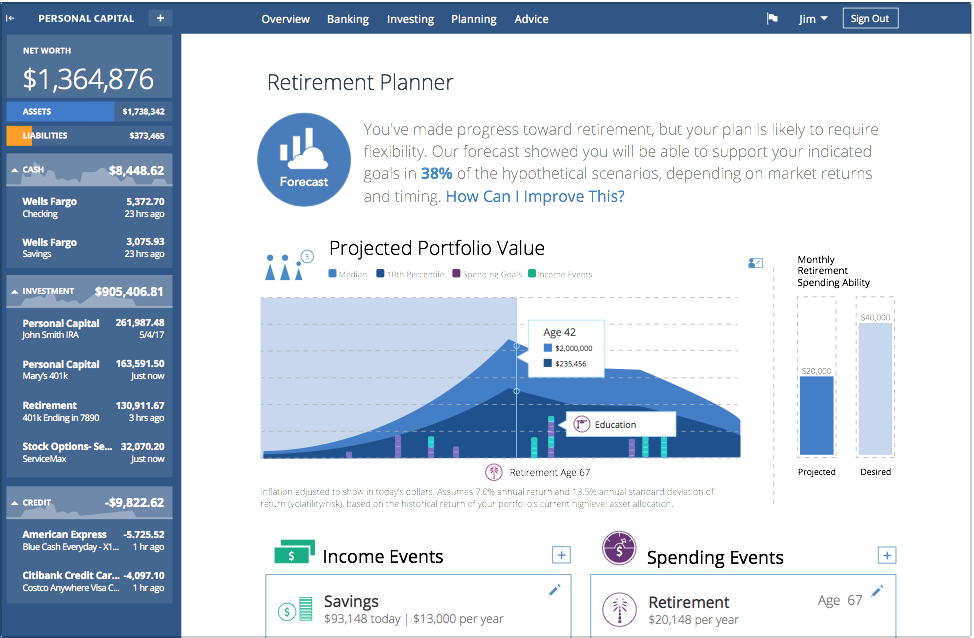

Our former financial advisor at Merrill Lynch used to produce beautiful graphs with Monte Carlo simulations at our annual meetings. He also used to create detailed retirement spending plans with a predicted likelihood of success. For this, we paid him tens of thousands of dollars over the years. Personal Capital offers the same services for free.

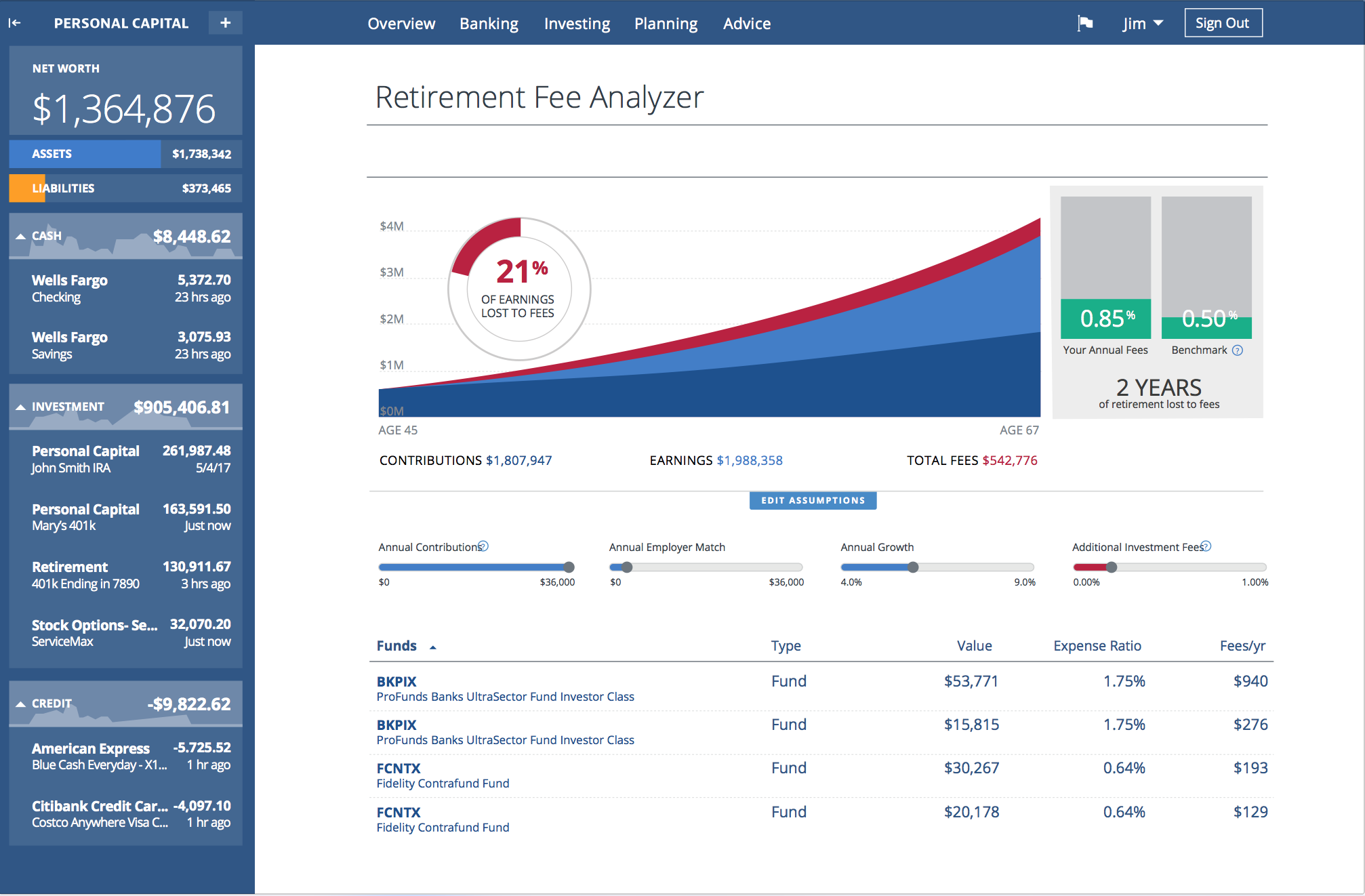

Using their Fee Analyzer I can see the effect of fees on my portfolio over time. With my overall expense ratio down to .07 across all accounts, I get a rush of adrenaline every time I use this tool.

I can also see where my current asset allocation lies along the efficient frontier with their Investment Checkup. It feels good to reduce uncompensated risk as much as possible. Better still, with this checkup no one grabs me below the belt and asks me to cough.

They have a very intuitive Retirement Planner. I enter milestone financial events like purchasing replacement cars, paying for my kids' weddings, etc. I can also enter conservative estimates of my anticipated income from social security in retirement, factoring in my pessimism in government competence. Want to see what might happen if I retire in five years instead of ten? I can easily alter certain assumptions and see how it would impact spending in retirement.

What's the catch?

Personal Capital is a blended human/robo financial advisory service, and offers these tools in exchange for having a crack at getting your business. They reach out to high net worth individuals (identified by linking their account info) by phone and email offering to give them a complimentary consultation, then pitch them. I've written previously about my experience speaking to my assigned Personal Capital advisor. As a physician, I get hit up by lots of folks looking to get a piece of my business, and I have no trouble politely declining services I don't need.

Isn't it risky to link your accounts on the interwebs?

They minimize that risk. Jim at Wallethacks wrote this detailed article explaining the safety measures Personal Capital has put in place.

Wait, I thought you were on my side. What's in this for you?

If you sign up, I may receive a referral fee at no cost to you. I log onto Personal Capital once a week at a minimum, and it's the main tool I utilize to direct new retirement contributions every month. It's the tool I use for my annual rebalancing as well. I endorse it because I use it.

Okay, how do I sign up?

I'd be grateful if you use this link.

Comments 5

Personal capital is terrific and so user friendly. Your post has my curiosity running wild… if housing, transportation, and food aren’t your “big three”, then what are they? Surely housing has to be up there; I know you live in coastal southern California where the cost of housing is sky high! 😉

Author

I can see how that could sound misleading. Housing is absolutely my top expense, far and above all other costs (as a fellow LA area resident, your suspicions are correct). I was surprised that transportation and food were nowhere near the top five. Our top expenses: 1) mortgage, 2) services (nanny/house cleaning), 3) health care, 4) taxes, 5) insurance. Probably sounded more wild in your mind than on the page…

Personal Capital is the best damn thing since sliced bread. It’s not perfect. It totally ignores tax planning which is a huge hole, but it really can’t be expected to provide this service. The single most important thing I ever did was to aggregate my accounts into a whole. Without it you have no idea what your risk is and what you are paying for it in return, and no idea of your portfolio’s efficiency. Without it everything is a guess and if you’re guessing you would be wrong.

Great post!

Author

Gasem,

That ability to view your portfolio as a whole is priceless, and the efficient frontier graph takes a lot of the guess work out of asset allocation. There have never been so many free smart tools available to allow one to be an engaged passive investor. Tax planning is probably where a good advisor or CPA make a difference, unless you are a DIY tax person who enjoys running different scenarios in turbo tax.

Fondly,

CD

There is a reason why personal capital is always prominently featured on financial bloggers websites (mine included) because it is an amazing tool and there really isn’t any competition to what it provides (that are free).