I recently posted about a friend whose wife had no tolerance for equity risk based on her negative prior experience watching her parents lose significant value on paper in the recession of 2008.

Ubiquitous commenter extraordinaire Gasem (who wrote a highly-regarded guest post on home schooling for this site) noted the false dichotomy that equities connote risk while cash, bonds and CDs are risk-free. He highlighted the fact that the latter, allegedly safer investments are unlikely to keep up with inflation over time, eroding their purchasing power.

Fellow blogger Xrayvsn followed with an insightful comment that posed the following deep thought: If the recession has produced a generation of investors who are overly conservative for having been "once bitten, twice shy," perhaps the post-recession bull market is creating a generation of investors who, never having been bitten, are overly aggressive in their asset allocation.

For lack of a better name, let's term them Generation DK after the Dunning-Kruger effect. Recall that Dunning and Kruger described a cognitive bias where someone with low ability and excessive self-regard thinks himself to be a high performer and lacks the insight to perceive his shortcomings. These are the D students who rate themselves as A students when asked.

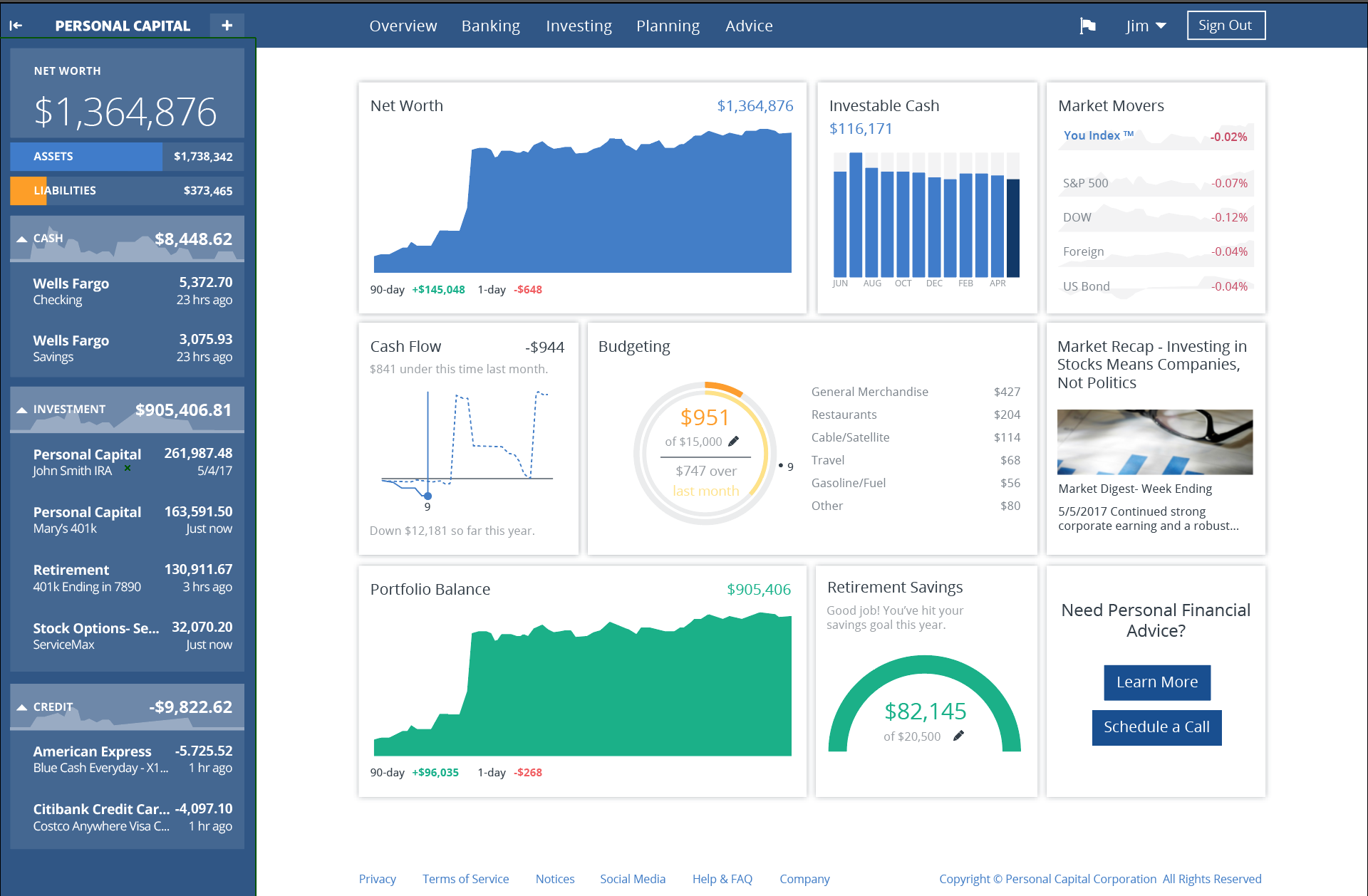

This time it's personal...Personal Capital. See how your investing expenses compare to the average.

While not all young investors are bound to overestimate their confidence and assume excessive risk by virtue of their youth alone, data demonstrate that willingness to take risk declines with age. It's not that millenials are more irresponsible than their elders - they are simply younger. Conversely, irrespective of experience, simply being older is associated with a reduced acceptance of risk.

You appetite for risk will mellow, just as surely as you will someday hike your shorts up to your nipples and suggest meeting friends out for dinner closer to 5PM.

William Bernstein is fond of saying that the young investor at the start of his career should pray for a bear market. Dr. Bernstein's logic is that such an investor would benefit from pouring in money when stocks are being sold at a steep discount, far from the time when he will need to withdraw this capital, so that the eventual market recovery slingshots his accumulation phase forward with a nice boost.

What would happen if a young investor, high on the self-righteousness of having read personal finance blogs, decides to invest solely and completely in 100% equities, and places all her invested chips in a single total market index fund like VTSAX? Let's say she has the misfortune to start investing in 2006, and proceeds to see her assets nearly halve their paper value.

A potential positive outcome from this scenario is that the young investor benefits from learning from her mistake when she stands to lose more gastric contents than capital. Two year's worth of investments are a pittance to pay in the grand scheme of things, she gets a better sense of her true risk tolerance, and adjusts her asset allocation accordingly when she had $20k invested instead of waiting to learn that lesson when she had $2 million invested.

Perhaps, then, there is less to fear from an early hyper-aggressive investor who loses money.

It's the hyper-aggressive investor who started investing in 2008 and has not felt the paws of a bear market rip through their self-esteem that poses the greatest threat to the future. Some fraction of of those investors are likely to attribute their fortune to their personal prowess: Generation DK. I'll be curious to see if these folks materialize, and if they'll become the next generation's equivalent of the mortgage crisis.

Maybe it's the recent trip to Greece talking, but the principle of hubris still carries weight these several thousand years later.

Comments 16

Just ask the smarty pants who bought Bit Coin at $10K or the Winklevoss twins who used to be billionaires. Just ask the guy who went all in in SPY in 1999 just before the dot.com bubble burst. That guy didn’t get even on his initial investment till 2013, 14 years of treading water. In 2008 in my opinion we barely missed full on deflation. Hank Paulson and Robert Reubin saved us. We were seriously overlevered as a country. It wasn’t just the debt sellers at fault, the slicers and dicers, but it was the debt buyers as well, the people who thought they could buy a McMansion and then take a second mortgage on the place and buy a couple cars a boat and a down payment on an airplane. all the while making a living as a cabbie.

What Paulsen and Reubin did was to put the banks on idle instead of making them go out of business. Banks represent 1/3 of the value of the market. If the banks go out everything goes out. The banks were allowed to exist on a 200bp profit while the Govt stress tested the hell out of them forcing them to do no lending. In the mean time the Government hoovered up the “bad” paper onto the Fed balance sheet and let time pass. Much of that paper would, and did perform if you just gave it time to mature. In the mean time people fixed their own balance sheets and repaired their credit. In the low interest rate environment business recovered over a decade. If you bought SPY in 2008 you weren’t smart you were lucky, same as the joker who bought in 1999 was unlucky. Basically Paulson and Reubin used the power of compounding to get us out of the jam. 2008 investors did well, Dumb Luck.

So how do you win? If you were the 1999 guy, didn’t sell, and you bought 1000 shares every year come hell or high water by 2018 you’d have 19,000 shares. If you were the guy who bought in 2008 in 2018 you’d have 10,000 shares. Who is richer? Stocks are not cash. Stocks are money making property. If you own a stock you own a piece of private enterprise. You own your neighbors work ethic who gets up every day, goes to work to add value to your shares. It’s a hell of a deal.

I believe in modern portfolio theory where a portfolio is made up from non correlated assets. Stocks and bonds have a -.01 correlation i.e. virtually uncorrelated. I believe in re-balancing and risk management. If you own a 50/50 portfolio (just as an example) when your stocks go high say to 60/40, you sell some of the 60% and re-balance to 55/55. Next time stocks go to 65/55 and you re-balance to 60/60. Now the bear comes and stocks fall to 30. You re-balance to 45/45 taking the sell high profit money you’ve been stashing in bonds and buying new shares low. You automatically and mechanically make the right move. Your fear does not enter into the equation.

Let’s look at risk, SPY has a market risk of 14.3% A 50/50 portfolio has a market risk of 7.35%. Virtually half the risk. If SPY goes down 50%, 50/50 goes down only 25%. SPY has to grow 100% to get even. 50/50 has to grow only 50%. The difference in “getting even time” can often be years (recall our 1999 player). That means if you own 50/50 you will be compounding away while SPY is just getting back to zero. This is a point often missed. SPY has a return of 10.3% and 50/50 has a 7.8% return. SPY is double the risk but only has 2.5% more return. You pay for that dab of extra return with a LOT of risk.

To paraphrase Carville, It’s the power of compounding stupid, just like it was the judicious use of compounding that saved our bacon in 2008.

So what’s the take away? Nobody is smart. You are a flea and you go where the dog goes.

Everybody gets high

Everybody gets low

These are the days where anything goes.

Buy into the market every year, don’t pay too much risk for your return, re-balance, front end load as much as you can early in your life. Look at your retirement portfolio as a product you are purchasing like a car or a house. Some of your money will go to purchase it while some of your money will go to other things like student loans mortgage and college funds. Do not buy into some perverse retirement schedule by quiting too early. Your main gig is your most valuable gig. The real race is to have enough to not die poor. Retiring early may be a possibility but it is not the goal at the expense of running out of money when you’re sitting around drooling.

The percentages were chosen for ease of head calculation and example. I’m not suggesting a 30 yo should have a 50/50 portfolio.

Author

Gasem,

I like the product purchase analogy – there are years where a bum water heater or roof repair will certainly undermine your returns, but it’s all part and parcel of the long-term plan. Bernstein is right on target with the goal of not dying poor (as opposed to dying rich), although for most folks in this particular conversation, it’s likelier to be the level of relative comfort at retirement.

Appreciate the illustration – the risk reduction element is a critical piece.

“You are a flea and you go where the dog goes.

Everybody gets high

Everybody gets low

These are the days where anything goes.”

Gasem, is this a poem? Because it it’s not.. it sure as heck sounds like poetic genius.

Anyway, I am 35 years old. Been in practice for only 4 years. And relatively aggressive. I have 80% equities, 10% bonds, 5% alternatives, 5% cash. Do you think this allocation is too risky? Who knows. I guess I’ll find out how I feel when the next market downturn happens. But I do hedge my risks on the fact that I think I have a stable job situation and my salary will stay the same whether there is a bear market, bull market, or however the economy is doing. Plus I don’t live on much of my income anyway. If a recession happened, I am confident that I will stay invested (I’m not living on or relying on this money anyway and I plan to work another 20 years).

But if anybody has better thoughts, I’d appreciate it. I’m always open to learning from people who are much wiser, smarter, and more experienced than I am.

Thanks!

Author

DMF,

I’ll leave it to Gasem to reply directly, but I believe the lyrics are Cheryl Crow’s “Every Day Is A Winding Road.”

-CD

DMF the verse is my massage of Cheryl Crow. I knew CD would get it. You can use the Personal Capital efficient frontier analyzer to get an idea of your portfolio efficiency and recommendations of asset allocation. I use portfolio vizualizer

https://www.portfoliovisualizer.com/efficient-frontier

I think the way to look at it is when the crash comes remember you own shares, not money. Shares are property and the value of property goes up and down. Hold on to your property and add more especially when cheap. By using an efficient frontier analyzer, if your on the efficient frontier you have mathematically optimized your risk for a given return (or vice versa). I tend to run my portfolio at 2/3 of market risk which I generally define as the risk of SPY (about 10%) and I pay attention to tax loss harvesting and when available and re-balancing. I don’t pay that much attention to return since for a given risk it will be what ever it is for any given year or sequence of years.

Author

Gasem,

I’m also a huge fan of the Personal Capital efficient frontier analysis – their free software providing feedback on your investments is easy and intuitive.

You echo the wisdom of my great-grandfather, a Ukrainian immigrant who started as a peddler selling clothing on the docks in Havana, pinched every penny, and invested it all in buying agricultural land (tobacco lands in what was then the boondocks of Pinar del Rio, Cuba). He believed you buy as much land as possible and never sell it (your version: buy and hold property in the form of equity). Sadly, he lost everything when Castro came to power, and died on the island shortly after. I take my middle name from this man I never met, but whose influence remains.

Here’s to rebuilding in the generations that follow…

Well it is really nice to see a simple comment of mine being used to generate a really thought provoking post.

I like the “Generation DK” nomenclature. It will be a decade or so before we can see the true effects of investor behavior on those that just started investing at the beginning of one of the best bull runs we have ever had. Those that overestimate that market prowess may really feel the claws of the bear when it rears its ugly head.

Thanks for the mention 🙂

Author

Thanks for sending me down the rabbit hole!

Hubris indeed. I started investing in 2006. When the crash came in 2008, we had a nice chunk invested but nothing substantial. Since then I’ve been a “brilliant” investor. Everything I bought went up. I even dabbled in individual stocks and those did well too. In fact, with two 3-D printing stocks, I had two five-baggers. Fortunately, however, I discovered the financial blogosphere around 2012 and really started to study the finer points of investing. Then, around 2014, I eventually realized that I DON’T KNOW SQUAT. My investment prowess and stock-picking genius was a sham. I’m now a much more cautious investor. Because I’m in the first five years of retirement, and particularly vulnerable to sequence of returns risk, my allocation is currently 40% stocks and 60% bonds/cash. So, yes, I’m a wimp. But such wimpiness will allow me to survive the next market crash. That’s the game plan, anyway. Great post, CD.

Author

Mr. Groovy,

Wimps are an underappreciated class of investor – and they consistently outperform the self-proclaimed brilliant investors in rough waters. There’s a lot to be said for insight into how little one knows.

Always a pleasure to see you in the neighborhood, my friend!

I believe opportunities happen regularly but losing capital and waiting to crawl back to even is difficult. I now regularly DCA but when the market gives me a sale- I will throw down more capital. I have always believed the equities market is a buy, hold and pray. It is the regimented way that is played (as Gasem does) that gives you the expected likelihood of positive bets. I work much more on aspects of my life which I can more likely control- our spending, our planning, our human capital.

I really like the premise of this article, but I’m not quite sure that an investor with 100% allocation in a total stock market index fund would be considered hyper-risky versus prior eras. The investor who grew up in the 1990s would be a more extreme example of a hyper risky investor. They made a ton of money on tech stocks in the 1990s, and invested their life savings in a dotcom stock in 2000 would potentially be a better example of Generation DK.

That being said, investors who grew up investing in the 2010s have a skewed understanding of the ups and downs of the stock market, and could be in for a rude awakening when the next bear market occurs.

– Wall Street Physician

Author

Point well-taken, although both generations could be argued to be placing all their chips on the table and letting the pile ride with each new spin of the wheel. Perhaps the 1990s era investors were simply the unluckier version thanks to the dizzying climb followed by a spectacular crash.

Reminds me of Spanky’s famous saying from a Little Rascals episode long ago: “The bigger they are, the harder we fall.”

Thanks for stopping by, WSP!

Sorry I missed this thread earlier. It is great. I guess I am a survivor of the late 90s DK event. I have been thru 2 bears were I lost > 1 million dollars in a few months. I am worried for all these young investors who have never seen a bear market who are 100% equities. Some of them will be so shaken that they will never invest in stocks again. The dot.com bust psychologically was a big hit to me. I began to realize that no I am not so brilliant. In retrospect I never invested in infinity PE tech stocks that bankrupted. I learned to never be so overly concentrated in one industry. Even in my 30s I owned some muni bonds. By 2008 I was back to even and ahead. I stupidly over-concentrated in a muni bond offering that was insured. In 2008 the insurance became worthless and I actually lost some money on this bond because I sold it. Talk about illiquid markets. I learned that the diversification of a bond fund is worth the ER. I really think that it is somewhat stupid to be 100% equity without having been through even a correction much less a bear market. I think myrtle on the WCI forum will be to talk some docs in from the ledge when the first crash occurs for the youngsters.

Author

Hatton1,

A loss of $1 million – that was my net worth just over a decade ago! That more than qualifies you to offer sage advice to the young and aggressive investor with ostensibly hypertrophied investing gonads.

You raise an interesting point, in that I have friends who purchase and set up their own bond ladders, assuming their collection of 15 munis is sufficient diversification. They enjoy spending time on the optimization, and while obviously most who blog or read these blogs do as well, I’m happy to relieve myself of the responsibility and delegate it to Vanguard in their CA tax-exempt muni funds.

I’ll check out myrtle’s posts on the WCI forum – thanks for the recommendation.

Appreciate you,

CD

Mrytle is an autocorrect for my role. HaHa