I've written previously about my attempts to teach our children about investing in order to demonstrate the value of letting your money work for you.

With the raging bull market, it had been an easy lesson, since every time we checked their investments they could see gains. Now comes the greater challenge.

How can I teach my kids to stay the course through corrections and bear markets?

When we started their financial education, they earned interest through the extremely high yield Bank of Mom and Dad. This reinforced the value of saving.

Once their investments reached an agreed upon threshold, each child had their savings invested in a Vanguard ETF that reflected extremely low cost, passive index fund investing. My daughter is in VTI, my son in VOO.

The first of each month is Compound Interest Day in our household. We sit down to review their investments and add in any savings or subtract any expenses.

When they save enough to purchase another share of the ETF, we buy more.

How did we deal with the recent drop in their investments?

We looked at trends over time.

First we graphed the performance of VTI over the past month.

The kids looked frightened.

Next, we graphed the performance of VTI over the past 6 months.

The kids were less scared, but sullen that they had lost any gains over that time period for essentially flat performance.

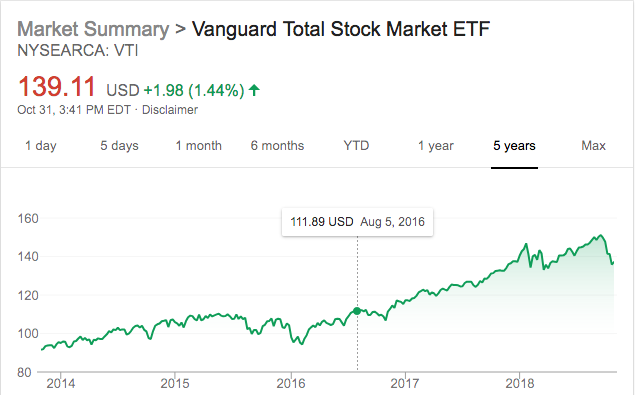

Finally we looked at the performance of VTI over the past 5 years.

Now they smiled in recognition of the upward trajectory they'd grown accustomed to.

Both kids seemed to understand the take home messages:

- Corrections, bear markets, and short-term volatility are natural elements of normal market cycles.

- Over a long enough time horizon, the market always goes up.

- There is wisdom in becoming an Oblivious Investor.

How are you preparing your kids, mentees, colleagues or spouse to stay the course?

Comments 7

Awesome parenting CD.

Your kids have learned financial lessons already that most investors don’t learn until much much later (if they indeed ever do).

Did you establish a custodial brokerage account for your kids to do this?

Author

Originally, when my daughter was born, we established an UTMA. For these small amounts, instead, I created a separate brokerage account within our holdings at Vanguard where I hold on VTI (daughter’s investment) and VOO (son) but the account is mine.

It simplifies tax reporting, and should they ever be inclined to spend the funds in a way I find concerning (hookers/blow), I can simply postpone gifting them the money. I think the odds of that are extremely low – mainly it’s the ease of tax reporting.

Nice demonstration of the benefit of being a long term buy-and-hold investor. It might be equally educational to pull up some charts of VOO/SPY before, during, and in the early years after the Great Recession at next month’s meeting.

Author

Terrific idea, thanks for the suggestion Vagabond!

overlay some BRK.B on VTI or VOO and teach them about single stock v funds risk. Also:

VOO is 13.22% and 10.89 risk correlation = 1

VTI is 12.99% 11.32% risk correlation = 1

BRK.B is 13.67% and 12.88% risk correlation = .7

Mixing VOO and BRK.B in a tangent AA of 72/28 gives a net portfolio of 13.55% and 10.7% risk More return less risk.

The numbers look high because VOO’s averages only go back to 2011 and the market has done great over those 7 years

That’ll really blow their minds

Author

I’ll save this lesson for when they are ready for more advanced concepts of risk – need to build to that lesson. It blows my mind as much as it does theirs, my friend.

Thanks,

CD

Our kids are really good savers. We haven’t gotten into investing with them yet. However, they have learned a bit about extorting high yields when they find the IOUs in their piggy banks…

-LD