Three and a half years ago, we decided to incentivize aggressive saving and demonstrate the power of compound interest to our kids by offering them exclusive access to the Bank of Mom and Dad. That experiment, we are pleased to say, has thus far been a success.

We gave them a sweetheart deal for maximal impact: 5% interest compounded monthly.

To give you an idea of just how good that offer is, if you begin with $100 and compound it monthly for a year at 5%, making zero additional deposits, you end up with $179.59, nearly doubling your money in a year. If you start with $500 under identical circumstances, you end the year with $897.93.

Certain entities can be manufactured without being easily replicated: I'm thinking of the highly unstable atoms that adorn the end of the periodic table, whose synthetic existence in a lab is fleeting at best (Nobelium-254 has a half-life of 3 seconds). Our extremely high interest rate was clearly not going to be found occurring in the real world.

We wanted the kids to witness what passes for a geologic time event in an accelerated manner, providing a time-lapse video of their growing bank accounts. We assumed change needed to occur rapidly to register as meaningful in the minds of what were then a 7 and 9 year old.

We established a tradition of labeling the first of every month Compound Interest Day, where we would give a report of their investments and the interest they had earned. I'm pleased to report the monthly tradition continues to this day. As they witnessed their net worth increase, the kids became more aggressive about saving.

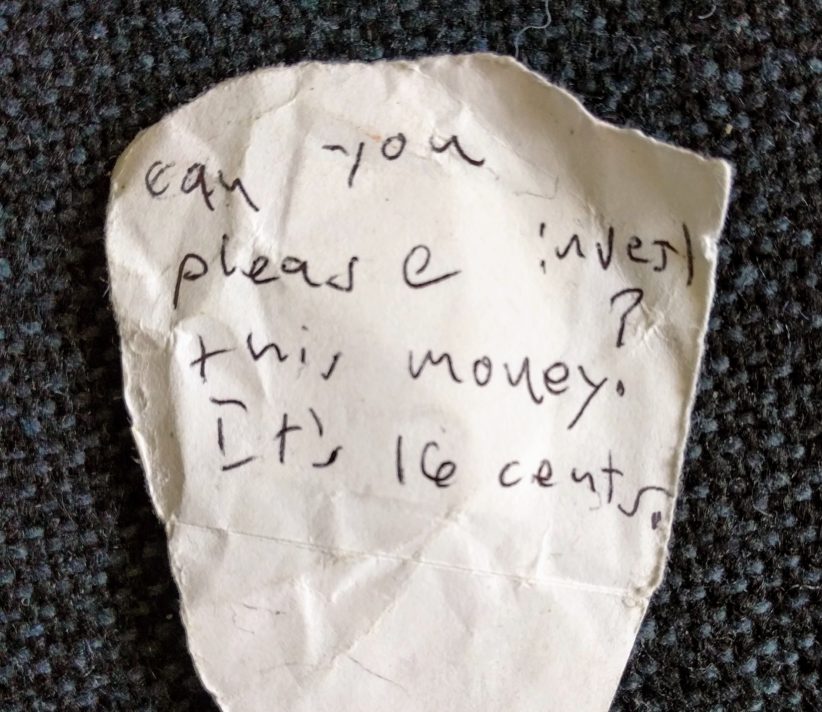

Pennies and nickels found on the elementary school yard were brought directly to me for immediate deposit on the day of discovery. $20 bills during visits by grandparents, formerly left to molder in piggy banks, were instead given directly to me for investment. Although they didn't know the term for it, they quickly grasped the concept of cash drag.

The Bank of Mom and Dad also produced minimalist dividend in our home as well. Birthday gifts could be either opened and enjoyed or, alternately, redeemed for a deposit credited at the going value on Amazon (at which time they would be promptly placed in the re-gift section of a storage closet). This reduced clutter in the kids' rooms, trending toward fewer, higher quality items they used more often.

A low grade competition developed among the kids, with my son eager to vault his net worth above his sister's (he's narrowing the gap, to his great delight). This did not mean that the kids became misers; instead, they became more intentional about their purchases.

Birthdays and holidays that had previously enabled spendthrift behavior were now transformed into opportunities to invest or exercise delayed gratification. My son might spend hours poring over lego sets to determine which single large set he might want to save up and purchase using his combined birthday and holiday gift money - investing roughly half and spending the other half.

Once their savings hit a designated threshold, we stopped subsidizing their investments and transferred their holdings from the Bank of Mom and Dad to the stock market to learn about passive investing in index funds. My daughter is invested in VTI, my son in VOO. I hope to use these funds someday to help them out with milestone purchases (a first car; as part of a home down payment), but opted not to start an UTMA account so as to retain control over it, at least for the time being.

This was helpful, as they rode the highs of irrational exuberance, endured their first significant correction this past March, and then watched the market rebound. They were able to taste volatility, and that was valuable. While concerns regarding the long-term viability of passive index investing as an investment strategy are understandable, it seemed a safe and reasonable way to introduce grade-school children to complex investing concepts and experiences.

My daughter's net worth has increased 15-fold over the trial period, my son's has increased nearly 22-fold. Each has a net worth in the low 4 digits.

When they receive gifts, they trade-in anywhere fro one quarter to one half for credit that applies to purchasing more shares in their respective ETFs. Cash gifts most often get deposited, although with adolescence my eldest has asked to hold onto more cash gifts.

I suspect retaining cash provides an important sense of control over destiny at a time where COVID has called that control into question. Since we also mandate pre-approval any purchases made using Bank of Mom and Dad funds, it's a clever way our adolescent has found to potentially bypass parental supervision. I am equal parts proud and terrified of that acumen.

Overall, we have cultivated two young savers and helped them transition into investors. They've established a practice of delayed gratification; thoughtful advance consideration of purchases (a behavior the psychology data suggest leads to increased satisfaction with one's purchases); and they've both developed a bias toward putting money to work earning more money.

Do we have regrets? We have not emphasized philanthropy enough. I need to make giving to those in need a more central and visible part of their (and my) practice, as most of it occurs behind the scenes using our donor-advised fund.

This will be the emphasis of our next course-correction in teaching the kids about finances.

What have you done to avoid screwing up your kids' relationship with money? What worked out well, and what do you anticipate will require years of therapy?

Comments 14

That’s awesome to hear that your kids are picking up in your financial footsteps.

I too created a bank of dad but perhaps went overboard with the rates (I have it at 12% annual and it compounds daily like an actual savings account I have).

I love the rationale you gave for your interest rate of changing geologic time into something a kid can appreciate. My daughter definitely had the light bulb moment and similarly throws a lot more cash into it because she sees the benefit of compound interest.

Author

Xray,

I want access to your daughter’s bank! We may have gone overboard with the interest rate, and used a sledgehammer to do a job that a regular mallet might have performed adequately, but the kids did get the message.

Thanks for visiting,

CD

Great post! We have done something very similar with our kids, albeit with a much lower interest rate and less frequent compounding – 5% compounded annually. In fact, we just had our annual interest deposit last week; the kids did the calculation themselves and watched as I made the transfer of “free money” into their accounts – cha-ching! The thrill of investment returns has taken root.

I’m always interested to hear how other families have chosen to introduce their kids to financial concepts. What we have done is set their weekly allowance at their grade level ($7 in grade 7, for example). At the beginning of the year, the kids get to decide how much of that they get in cash and how much will be deposited directly into their account. Having them involved in the decision making is key, I think. They usually take about 1/3 in cash, but most of it ends up accumulating and being deposited at a later date.

They are incentivized to save in several ways:

– they know that at the beginning of every school year, they will get 5% interest (free money, baby!) on their account balance

– we have committed to matching whatever they have saved for post secondary education when they are 18 (this is above and beyond their RESP, which is the Canadian equivalent of a 529 plan)

The results of our little system have been great. Knowing how good it feels to have a bunch of money growing in the bank is addictive and motivating – they are all (we have 4 kids) excellent savers. They are also excellent earners – in the last few years each one has figured out a different way to make money on their own: mowing lawns, knitting baby blankets, hand-made greeting cards . . . there always seems to be an entrepreneurial venture taking place around here.

The last point I wanted to make is that we let our kids make bad spending decisions. Sure, we coach them gently on the dangers of impulse buying, finding value, etc., but if they really want to drop $20 on some crappy piece of plastic, they can. You can also count on the fact that we’ll be having a conversation about it in a few months when it’s lying broken and forgotten in the corner of their room 🙂

Now all we can do is hope that they will leave the nest in a few years having established some good financial habits – and they won’t blow it all up once mom and dad are out of the picture 😉

Author

Matt,

Thanks for the in-depth description of how you are handling the boys’ financial education. I ought to have had the kids calculate their monthly interest, too! Lost math opportunity…

I like the idea of a parental match on educational savings. When my kids get to the point of earning enough to be reportable (my son has his eye on a job scooping ice cream once he’s old enough to be hired) I intend to provide a parental match in the form of a Roth IRA contribution.

We probably ought to be less intrusive when it comes to spending, and let them make and learn from those poor choices early when the stakes are lower – I like that you allow space for that.

We debated the idea of an allowance, and narrowly decided against it. Our kids have daily chores (dishes, cleaning kitchen) as well as basic expectations of cleanliness (pick up your room, no towels on bathroom floor) and we wanted them to feel that this was their expected contribution to maintain our household, akin to our going to work. We were concerned that an allowance would let them feel like they could opt out of chores and pass on the allowance. It sounds like it is working out well for you guys, which is reassuring.

Curious, Matt, how do you balance your boys’ interest in industry vs. art?

Thanks for stopping by,

CD

We’re on the same page that allowance should not be tied to chores. We all have chores – it’s just part of living here. If they don’t do theirs, they might not find food on their plate at dinner time! In our house, allowance is not compensation, rather a tool to help them learn lessons about spending and saving that we think are best learned by having a small but regular income stream. But there are lots of good ways to accomplish the same thing.

As for balancing their interests in industry vs art . . . well, that’s up to them. I’ve observed a drive for both in each of our kids at different times. Their interests wax and wane, of course, but the important thing is that they are interested in something – and I help them run with it as best I can. The cool thing is that industry and creativity are so synergistic – the former motivates the latter and the latter amplifies the former. Especially at a young age, I think breadth of experience is hugely beneficial. So far, it seems we are not raising specialists 🙂

Author

Matt,

Kudos to you for raising generalists with wide-ranging, renaissance child interests in art and science!

I vacillated between the idea that our kids should get an allowance for the experience of making mistakes and learning, and then decided to opt them into investing lessons instead…although as they get older an allowance might be resurrected.

Appreciate the chance to learn from you,

CD

This is awesome. I have always thought that when my little girl is old enough, I’ll teach her more about money and let her save in the bank of mom and dad. When do you think kinds are old enough? About 5 years old?

I really like your idea of this minimalist dividend where your kids can resell their gifts. As a minimalist and as someone who is concerned about environmental issues, I really applaud this. My wife and I really don’t like clutter. And we both tell our families not to give us or our daughter any gifts because we don’t really need anything. I think it’s very sad that more than $15 billion is spend on unwanted gifts over the holidays. And this is just over the holidays and not including other celebrations like birthdays. Let that sink in. The really sad part is that most of these gifts are probably cheap plastic that doesn’t degrade and will stick around in this Earth forever, at least way longer than we will be here.

My wife and I are really trying to be stricter with our no gift policy.

Author

DMF,

Thanks for the kind words. Five sounds about right, although it varies somewhat with the kid. We tried a no gift policy, and it largely failed due to generational norms. I’ll be curious what strategies you adopt, and I hope they bring you better luck.

Fondly,

CD

I have nothing to say about raising financially savvy kids.

However, as regards charitable giving: many, many years ago when I lived in a house with 4 other people (not related to me), we had a charity box. We would put money in when we felt like it, and every month or so we would get together and decide where to send a donation (or two, or three).

This may put you at risk of getting on too many mailing lists (I have confidence you can find a way around this), but it is a nice way to model charitable giving and get your children involved.

Author

IM-PCP,

That’s a great suggestion and a way to make our giving visible and transparent. I’m brainstorming how to do this in a primarily non-cash household, as the kids usually entrust their cash to us to invest. Perhaps I’ll incorporate some sort of invitation to donate a percentage of gains on Compound Interest Day…

Appreciate the instructive anecdote and the visit,

CD

https://www.foodforthepoor.org/gift-catalog/wb/2020-christmas-8821/

I have several charitable interests but this one is excellent for kids and parents. The gift of a goat is not trivial. The gift of a breeding pair brings true stability to a community since if you get a breeding pair you can grow a herd but also MUST give a pair away and the recipient MUST give a pair away etc. Growing a herd involves a family commitment and responsibility. If you drill a well, add a little salt and a village has the chance to fight the deadly aspect of dysentery. If you build a house, a family gains the stability of possessing an address. This turns the “concept of money” into a concrete narrative regarding the “true power and value of money”. I supported a bunch of kids and abandoned elders and always gave “one” to my Mom who then had a new grandchild to correspond with and pray for. Over the years she’s had a dozen extra grandchildren from all over the world and marked their progress through their lives even all the way through college and into marriage. I have a 30+ year history with this charity.

Hard to beat an egg, to sustain a life.

Author

Gasem,

Thanks for the referral – it looks like a promising way to make charity go from abstract to concrete.

With gratitude,

CD

Great post. I wish we had done more with the Bank of Mom. I paid interest, but not at that level and so never got real buy-in from one of my sons. Our adventures in philanthropy may be of use to you however. Each year, the day after Thanksgiving, we have a meeting of the Johnson Family Foundation to distribute the proceeds of the previous year. (Mom funds this with about $500 or so depending on financial stability, whim and the state of the world- Foundations have varying finance too) The boys present their bids for charities that we wish to support as a family. They make a pitch to the rest of the family. Then as a family we vote on the distribution. This is over the tithe that we participate in from allowance and from my earnings. The idea is that from those whom much has been given, much is to be shared. They have gone with me to missions, packed kits for refugees and planted trees. Sometimes cheerfully, sometimes, not so much- but they showed up and worked, and felt proud of their efforts. I know that you have done that with your children as well. The children’s charity pitches have evolved from “we need to give to the shelter to help the puppies” to a power point on a Border ministry. I’m very proud of them. This has been impactful with little effort. The Johnson Family foundation holds a sweet place in my heart. I hope the tradition continues for future generations, since I learned the joy of giving at my Grandfather’s side.

Author

Austin Mom,

Sounds to me like your boys will get the experience of materially participating in good works; the example giving generously; and the perspective of needing to advocate for their charities of choice (powerpoints, no less!) at the Johnson Family Foundation debates. That’s a remarkable legacy and something I’ll definitely adapt and incorporate into what we’re doing with our kids.

Thanks for sharing your playbook,

CD