[Disclosure: If you register for WCI CON 22 using this link, I make a modest commission at no cost to you.]

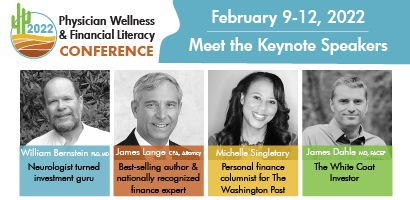

Enrollment has begun for the upcoming Physician Wellness and Financial Literacy Conference 2022, offered every 1-2 years by the White Coat Investor. You have 5 days to score early bird pricing on in-person attendance.

I was a speaker at the 2020 convention, which took place in March and coincided with the COVID's arrival in the US. It added a weird twist to an already surreal scene, but that will not be the subject of this post. Instead, I'd like to come at it from the perspective of someone who had always envisioned someday attending, and wasn't certain what the experience would be like.

Affectionately termed WCI CON, it's comparable to a Trekkie convention that attracts several varieties of physician finance nerds (both speakers and conference attendees) under one big tent.

- There are those seeking to increase their happiness via unconventional career paths in medicine. This includes folks pursuing early financial independence to reduce the aggravations of medical careers they'd otherwise enjoy, exchanging their plank for a runway; early retirement cheerleaders like the Physician on Fire, representing folks who'd like to embark on their second act before they reach their 60s; frugality and mindfulness enthusiasts (two great tastes that taste great together), encouraging doctors to become dirtbag millionaires; and refugees from burnout seeking both fellowship and potential solutions. They wear jeans, and hanging out with them makes one feel grounded and accepted.

- There are the newbies looking up their finance game - excited to assume control over their portfolio, cautious about selecting the right type of disability and life insurance, trying to right a ship that's been off course for years, or otherwise looking to take on Advanced Placement coursework in charting a path to financial security. You can spot them by their excited puppy dog eyes and endless questions about the backdoor Roth IRA. They are adorable, and hanging out with them brings back all the wonderful feelings from the honeymoon phase of discovering personal finance. It's what a friend once termed the theory of la escalerita - if you are one rung up the ladder you extend a hand to help the person below, and everyone benefits from the camaraderie that results.

- Finally, there are the golden parachutists, business minded docs (most of whom own and invest heavily in real estate) who are out to share their secrets to developing a passive income stream independent of one's medical job. They are charming, snazzy dressers, and still have dinners with their college friends who succeeded wildly in venture capital. Hanging out with them makes one feel inspired and capable of accomplishing any goal.

Taken in its totality, the docs who both lecture and attend this conference make for a very solid support group in helping you make progress on your path to financial literacy and security. You arrive thinking you are firmly grounded in one tribe, only to be seduced by the lessons of another.

If you are new to the conference or the crowd, like Trekkies, you pick up on the vibe of radical acceptance. Why aren't folks more judgmental? When everyone's a misfit in one way or another, no one's all that quick to rush to judgment. The many podcasters, authors and bloggers in attendance have (mostly) small egos and (universally) genuine enthusiasm to meet their readers / listeners.

What WCI CON does well is provide lectures that are of interest to an overlap of the three groups. For example, while I'd categorize myself as a happiness through unconventional career path kind of guy, I attended many newbie lectures to meet writers I've looked up to for years like Harry Sit (a.k.a. The Finance Buff), Rick Ferri and Phil DeMuth (whose acerbic wit as a speaker I found hysterically funny). I was also drawn to the real estate gurus and their can-do attitude: Peter Kim (a.k.a. Passive Income MD), Letizia Alto of Semi-Retired MD, and the always brilliant Victor Mangona were inspiring lecturers.

As a sometime extrovert, one delightful aspect of attending the conference in person was being able to "host" a meal that other attendees could join, which for a frugal guy like me meant finding a budget option that looked great (a noodle house in suburban Vegas; a sandwich shop on the strip well-located for to-go orders that could be brought to a picnic spot by the Bellagio fountains). I met folks from very humble origins looking to get their finances right where their parents went wrong, couples looking to reach early FI with kids by living like residents early on, and some impressively organized young docs who are decades ahead in financial literacy compared to where I was at their age. I really valued these moments of direct connection while breaking bread.

Sure, there were a few dud lectures in the crowd. After realizing they were not the greatest fit for my needs, I'd make a discreet exit to head for the coffee and snack lounge, where a smattering of attendees was usually chatting away with some of the speakers.

The moments outside of the lectures were some of my most enjoyable experiences. They included grabbing a coffee with Jason Mizell, who has revolutionized financial literacy training for residents and medical students, and listening with rapt attention to Rick Ferri opining on the stock market tanking in real-time as we attended the conference (March 2020 was impeccable timing).

The 2022 conference will be hybrid, and there are trade-offs attending the conference online. On the one hand, you'll still get access to an impressive array of lecturers who might just turn you on to ideas and approaches to financial security that were not in your wheelhouse. The cross-pollination of ideas alone is a legitimate reason to attend.

Aware that smaller-scale discussions are an important facet of the WCI Con experience, the conference is providing scheduled breakout sessions to enable attendees to connect with speakers and panelists. Like college office hours, I suspect that despite being widely publicized only a few die-hards will actually show up and reap the benefit of more intimate discussions in connecting with the speakers.

The total cost of registration varies by product, with some interesting twists offered this year:

- In person options include

- $2299 premium in person package (early bird price) - a combination of VIP event access, reserved front row seating at every lecture, a Disney-like fast-pass that allows you access to a "fast lane" for drinks/meals, and eligibility in all wellness activities. Also, you get a branded Yeti mug for people who are into gear. I guess there's a 1% even among the 1%?

- $1699 standard in person package (early bird price).

- There is also now an option to add a spouse in person for $749.

- Virtual options include:

- $899 standard virtual package.

- $499 virtual live only package - the no frills version providing live access through Feb 14th, as it happens. For frugal types who want to take the days off of work, and watch it as it happens via computer.

All but the virtual live only package include "forever" online lifetime access, a swag bag (if you enroll by the deadline - jam packed with high yield financial books), and up to 17 units of CME or dental CE credits.

If you register before October 19th, 2021, you'll receive an early bird discount, but only on the in person packages. After that date, you'll need to shell out $2599 for the premium in person package and $1999 for the standard in person package

If my review helped you figure out whether this conference is right for you, I'd be grateful if you'd register using my link. If you do, I make a modest commission at no cost to you.