Every now and again I succumb to sappier impulses. It must have been from watching too many reruns of When Harry Met Sally back in the day. Forgive the indulgence!Makes 1 heaping serving of financial independence. Cooking time: Approximately a decade and a half after residency, depending on student debt, specialty income, and spending. 1 jar of resident lifestyle preserves …

Project Fi Update

It’s been four months since I returned my iphone to Sprint and my wife and I switched over to Project Fi, the no-contract cellular service operated by Google. Calls are routed preferentially via wi-fi when available, and on the Sprint or T-mobile networks when you’re away from wi-fi. We put Fi to the test by traveling out of country (Mexico …

The Five Stages Of Lawsuit Grief – Part Two

Acceptance Eventually, the ability to enjoy myself seeped back into my life, one area at a time. My kids sucked me back into their world that didn’t care about my troubles so long as I could splash them in the bath or read them a bedtime story. My wife was simply extraordinary. I didn’t feel deserving of my family’s love, …

The Five Stages Of Lawsuit Grief – Part One

I was tired – it had been a busy winter shift and my head was spinning, but I was slowly winding down after a nice family dinner and some reading time with my daughter. My wife and I had put our toddler to bed and were catching up when the doorbell rang. Taking a perverse pleasure in the humiliation he …

Notes from a Financial Toxic Wasteland

I’d heard California called many things before. The Golden State. A nature lover’s paradise. A youth and beauty parade. But the White Coat Investor (WCI) was the first to call it out as a Financial Toxic Wasteland. I describe myself as an unrepentant Californian, owning up to my idiosyncrasies and accepting the faults (and more reluctantly, the fault lines) …

Too Much

My wife runs a side hustle that has been in full swing all summer, and which despite being mostly a word of mouth endeavor has evolved over a decade into a full-time job. On top of this, she works one clinical day shift per week in the ED to maintain her skills. My 10 hour shift yesterday turned into a …

Cutting Back

Once upon a time, a strapping young buck dove into the field of Emergency Medicine with ne’er a thought of night shift fatigue. He loved his work, headed into each shift bright-eyed and bushy-tailed and relished the butterflies in his stomach that multiplied commensurate with the number of ambulance rigs in the emergency lot. He loved the social justice aspect …

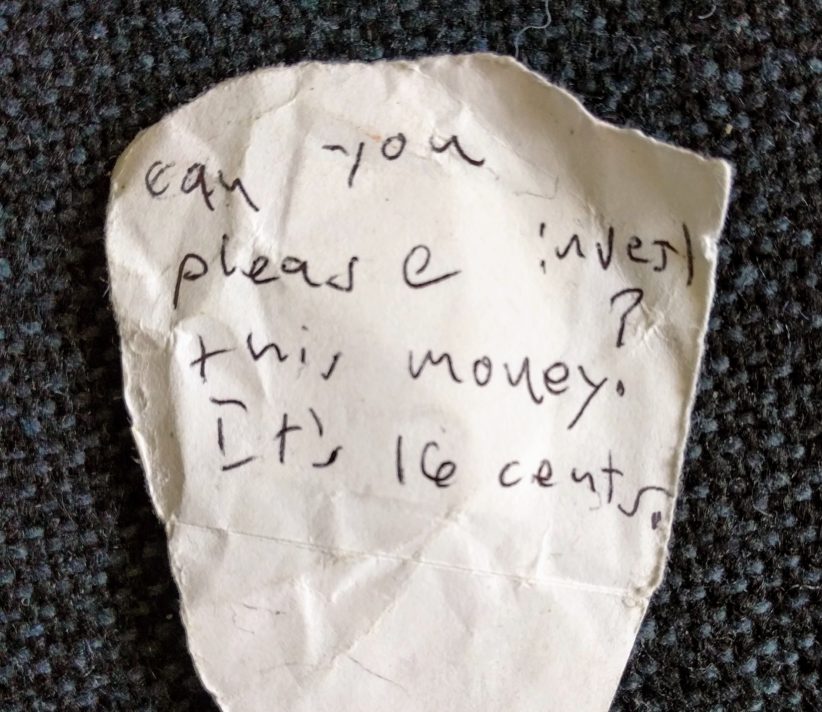

What the Bogleheads Taught Me About a Child Roth IRA

As a JV blogger looking up to my varsity role models, I’ve noticed that lots of folks seem to post photos of their children on their blog. I’ve always suspected their motives transcended vanity. As an evolving finance geek, this trend naturally piqued my interest: Could I pay my kids as child models on my blog and invest their earned …

High Income Vagabonding?

Since this blog is in many ways a time capsule from the current version of me to the person I was 15 years ago, there are concepts that occasionally resonate with the unencumbered new attending far more than they do with the married father of two with a mortgage and a bum shoulder. One such idea is the concept underlying …

The Ascetic Treadmill

As part of a fellowship in International Emergency Medicine, I spent six months (multiple trips over a two year period) in northern Ethiopia. One of the most otherworldly experiences I had during that time was exploring Lalibela, a town which occupies a revered place in Ethiopian Orthodox Christianity. A walk through town revealed temples hewn from single enormous slabs of …